Everything you need to know about saving tax – in 15 minutes a month – for just £8

The Schmidt Tax Report, is published monthly by Alan Pink, was founded in 1991 and is read by entrepreneurs, investors, and business decision makers, as well as by accountants, solicitors, financial advisors and other professionals including tax consultants (who say they find it a useful aide memoire).

Its primary objective is to explain (in plain English and without technical jargon) how you can, without behaving in an unethical way, legally save a substantial amount of tax. It also contains a great deal of other valuable information pertaining to tax, personal finance and property.

One of the key benefits of The Schmidt Tax Report is that if you wanted to you could speed-read it in about 15 minutes a month. However, you may find yourself spending much longer studying it as it is a remarkably enjoyable read. Alan (our editor) and his colleagues manage to make even the driest subject fascinating. The newsletter proves that saving tax need not be tedious or time consuming.

As a subscriber – even a trial subscriber – you have full, unrestricted access to our ‘Ask the Experts’ service. Ask any question you want for a detailed, confidential reply, whether it’s for tax returns, tax planning or just general tax advice.

Contents

The regular contents is described below. To read recent, sample articles click on the section that interests you.

- Connector.

News

A round up of relevant tax news stories

- Connector.

Editorial

A look at two or three current tax topics, plans and/or ideas

- Connector.

Feature articles

In-depth, action-orientated, tax-saving articles

- Connector.

Offshore column

News and tax planning including becoming non-resident

- Connector.

Top tips

Quick tips that could save you substantial sums

- Connector.

Q&A

A selection of the month’s ‘Ask the Experts’ queries

- Connector.

News

A round up of relevant personal finance stories with a tax angle

- Connector.

Alternative Investment

Low and zero tax investment options

- Connector.

Feature articles

Tax saving, personal finance articles

- Connector.

News

A round up of relevant property stories with a tax angle

- Connector.

Feature articles

Tax planning for property developers and managers

- Connector.

Property opportunities

Low and zero tax property investments

Examples of typical feature articles

-

- Tax planning if Britain leaves Europe

- Little known R&D tax breaks that almost every company can use

- The no- and low-tax way to sell your business or any other asset

- Buying a property: A tax-planning (tax-saving) checklist

- How to make your classic car, horses and other assets tax deductible

- Eight unfairnesses in the tax system and how to avoid them

- How Brexit will effect British expats and future non-residents

- The USA – an unexpected, 100% confidential tax haven

- 1, 5 and 10 year tax plans for those on above average incomes

- Gold mining shares – investment and tax saving opportunities

- How private insurance can save you tax

- A-Z of the tapered annual allowance for higher-rate taxpayers

- Investing in private equity release mortgages

- Why volatility is the property investor’s best friend

- VAT saving tips for small to medium sized businesses

- The huge tax advantages offered by UK farmland

- Pensions – a user’s guide for higher rate taxpayers

- Classic cars: the ultimate long-term investment

- The Furnished Holiday Lettings tax advantage

- 10 ways to benefit from incorporation relief

- Turning business and investment losses into tax gains

- 20 tax efficient ways to extract profits from your business

- Dealing with the Revenue: meetings special report

- How to make money from spread betting

- Beginners guide to investing in multiple occupancy (HMO) property

- How to avoid an HMRC investigation

- Tax advice for buy-to-let property investors in the new environment

- 12 property investment opportunities under £50,000

- Complete guide to avoiding inheritance tax

- How management charges damage your wealth (and how to avoid them)

The Editorial Team

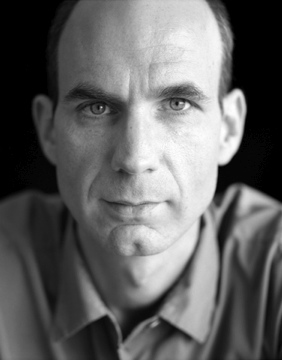

Alan Pink

Alan is one of the UK’s most experienced tax advisers, and specialises in all aspects of tax planning for owner-managed businesses (OMB). Having trained with a firm in the City of London and in the tax department at Deloitte, Alan moved out to the OMB tax advice sector as long ago as 1989, and has been devising structural tax planning solutions for clients ever since. A Fellow of the Institute of Chartered Accountants in England and Wales, and a Chartered Tax Adviser, Alan runs his own firm in Tunbridge Wells, Kent, in partnership with Paul Hyland.

Paul Hyland

Paul is a Chartered Accountant who has focused on providing tax mitigation advice to small to medium sized businesses and accountancy firms without dedicated tax departments since 1996. Paul is in partnership with Alan Pink.